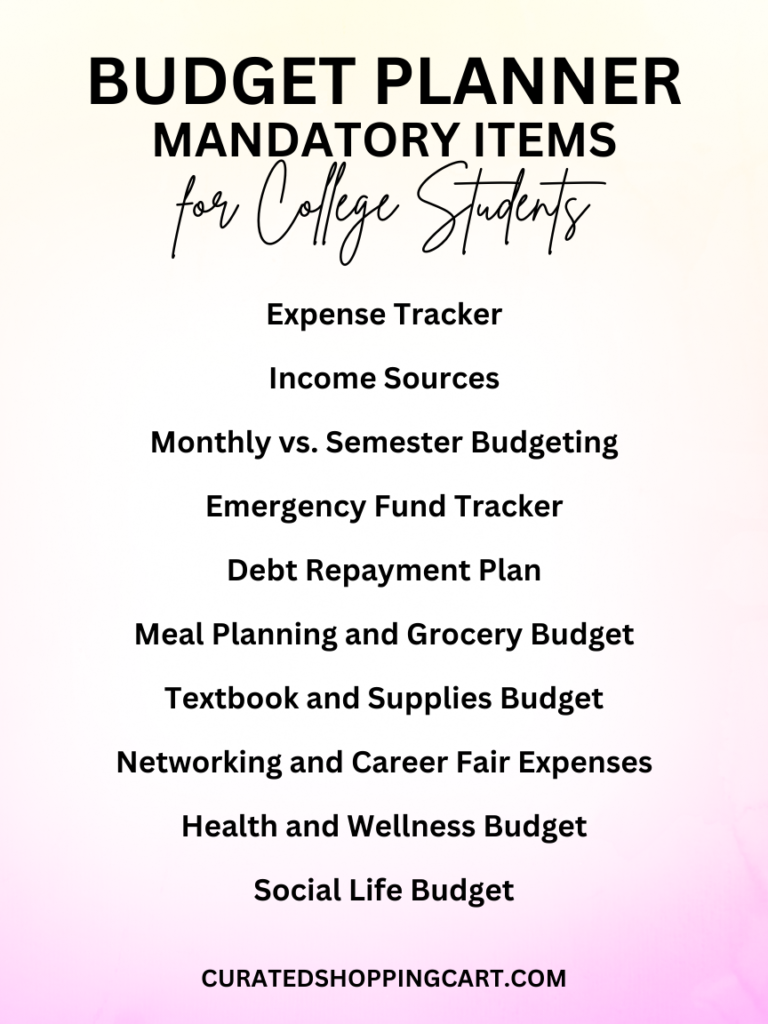

1. Expense Tracking with Categories

Let’s get colorful and creative! Here’s how to make your expense tracking pop:

- Create main categories like “Essential Expenses” (tuition, rent, utilities) and “Lifestyle Expenses” (entertainment, dining out).

- Sub-categorize further: Under “Food,” have sections for groceries, campus meals, and eating out.

- Use a color-coding system: Green for income, red for fixed expenses, yellow for variables.

- Include a monthly summary page where you can see all categories at once, like a financial dashboard.

- Pro tip: Add a “Miscellaneous” category, but limit it to 5% of your total budget to avoid overspending on unplanned items.

2. Income Sources Breakdown

Time to show where the money’s flowing from:

- List all potential income sources: part-time jobs, scholarships, grants, family support, side hustles.

- Create a pie chart to visualize the percentage each source contributes to your total income.

- Include a “gig economy” section for flexible income like tutoring, ride-sharing, or freelance work.

- Add an “income goal” tracker to motivate you to reach certain earning milestones each month.

- Bonus: Include a section on how to maximize each income source, like tips for asking for a raise or finding new scholarships.

3. Monthly vs. Semester Budgeting

Embrace the power of dual-timeline planning:

- Create a foldout page with your semester budget on one side and monthly breakdowns on the other.

- Use your semester budget for big-ticket items like tuition, books, and housing deposits.

- Monthly budgets can focus on day-to-day expenses and short-term savings goals.

- Include a “Budget Reconciliation” section where you compare your monthly spending to your semester projections.

- Add a “Flex Fund” in your semester budget for unexpected expenses or opportunities that pop up.

4. Emergency Fund Tracker

Building your financial safety net can be fun:

- Set a goal to save 3-6 months of basic expenses.

- Create a visual “savings thermometer” that you can color in as your fund grows.

- Break down your emergency fund goal into weekly or monthly targets.

- Include a list of what constitutes a true emergency to avoid dipping into the fund unnecessarily.

- Add motivational savings quotes or personal mantras to keep you on track.

5. Debt Repayment Plan

Tackle that debt like a pro:

- List all debts with their interest rates, minimum payments, and total amounts owed.

- Include different repayment strategies like the “Debt Avalanche” (highest interest first) or “Debt Snowball” (smallest balance first).

- Create a visual debt payoff tracker, like a series of chains you can break as you pay off each loan.

- Calculate and display how much interest you’ll save by making extra payments.

- Include a section on understanding loan terms, grace periods, and repayment options.

6. Meal Planning and Grocery Budget

Eat well without breaking the bank:

- Create a weekly meal planner template with a corresponding grocery list.

- Include a price comparison chart for staple items at different stores near campus.

- Add a section for collecting budget-friendly recipes, focusing on meals you can batch cook and freeze.

- Incorporate tips for using campus meal plans efficiently, like identifying the best value meals or times to eat.

- Include a tracker for how much you save by cooking at home vs. eating out.

7. Textbook and Supplies Budget

Outsmart the textbook racket:

- Create a course-by-course breakdown of required materials.

- Include a checklist of money-saving strategies: rentals, e-books, older editions, library reserves.

- Add a price comparison tool for different textbook sources (campus bookstore, online retailers, student exchanges).

- Include a section on selling back books or renting out your textbooks to others.

- Don’t forget other course materials – budget for art supplies, lab equipment, or specific software you might need.

8. Networking and Career Fair Expenses

Invest in your future:

- Break down potential expenses: professional attire, business cards, portfolio materials.

- Include a “Career Events Calendar” with estimated costs for each event.

- Add a section on DIY alternatives, like designing your own business cards or borrowing professional clothes.

- Include tips on making the most of each networking opportunity to maximize your investment.

- Create a “Professional Development Fund” to save for conferences, workshops, or certification courses.

9. Health and Wellness Budget

Prioritize your well-being:

- Break down health expenses: insurance copays, prescriptions, over-the-counter medicines.

- Include fitness options with varied price points, from campus gym membership to free yoga apps.

- Add a mental health section covering counseling services, stress-relief activities, or meditation apps.

- Include a “Wellness Challenge” with budget-friendly ideas for each month.

- Don’t forget personal care items – create a list of essentials and their typical costs.

10. Social Life Budget

Balance fun and finances:

- Create a “Free Fun Finder” section listing no-cost events and activities on and around campus.

- Include a “Special Occasions” fund for birthdays, holidays, and other celebrations.

- Add tips for hosting budget-friendly gatherings, like potlucks or movie nights.

- Create a “Student Discount Directory” for local businesses and attractions.

- Include a “Semester Splurge” section where you save up for one big social event or trip.

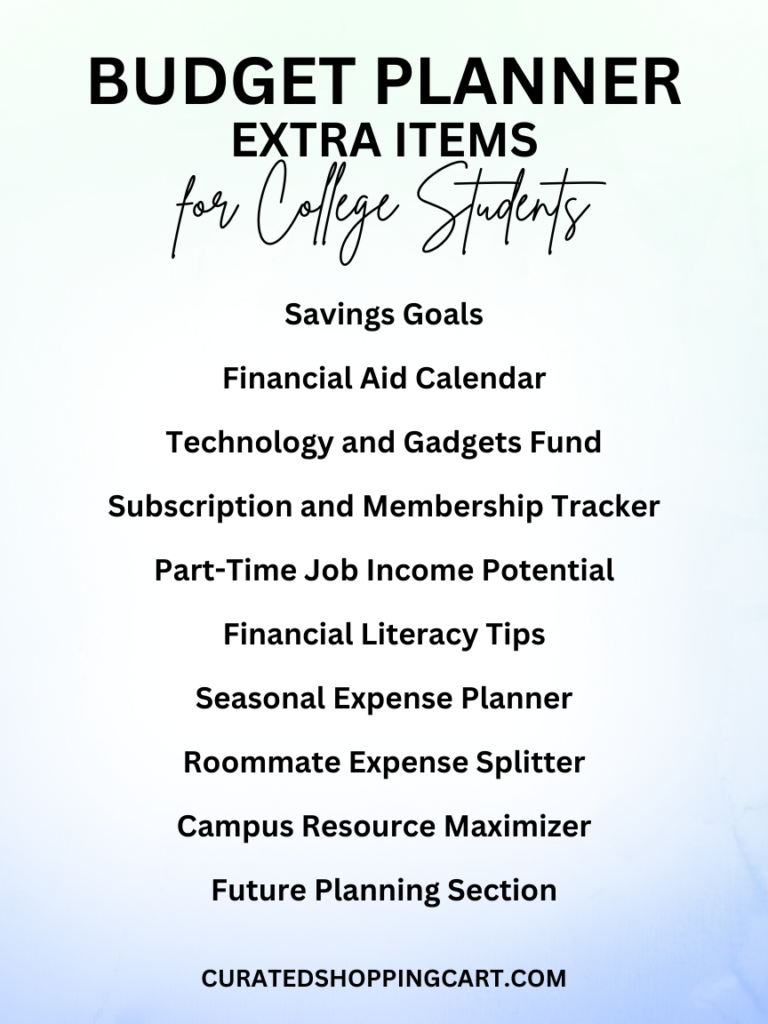

11. Savings Goals

Dream it, plan it, achieve it:

- Categorize savings goals: Short-term (concert tickets), Medium-term (spring break trip), Long-term (study abroad program).

- Use visual trackers for each goal, like filling in a suitcase for travel savings.

- Break down big savings goals into smaller, weekly targets to make them less daunting.

- Include a “Savings Challenge” section with ideas like the 52-week money challenge.

- Add a “Windfalls” box to plan how you’ll allocate unexpected money (birthday cash, tax refunds).

12. Financial Aid Calendar

Never miss a deadline again:

- Create a year-at-a-glance calendar with color-coded deadlines for FAFSA, scholarship applications, grant renewals, etc.

- Include reminders for gathering necessary documents (tax returns, income statements) weeks before deadlines.

- Add key dates for your school’s financial aid office, like when aid packages are typically announced.

- Incorporate a checklist for each major financial aid task.

- Bonus: Include a section on appealing financial aid decisions and tips for writing scholarship essays.

13. Technology and Gadgets Fund

Stay connected without short-circuiting your budget:

- Create a “Tech Inventory” of your current gadgets with estimated replacement dates.

- Include a savings plan for big-ticket items like laptops or tablets.

- Add a section on student discounts for software and hardware.

- Include tips on protecting your tech investments, like using protective cases or purchasing insurance.

- Create a “Tech Needs vs. Wants” checklist to prioritize your purchases.

14. Subscription and Membership Tracker

Manage those recurring charges:

- List all subscriptions with their monthly/annual costs and renewal dates.

- Include a “Value Assessment” column to regularly evaluate if each subscription is worth the cost.

- Add tips on sharing subscriptions safely with roommates or finding student discounts.

- Create a calendar reminder system for free trial end dates to avoid unexpected charges.

- Include a total monthly/annual subscription cost to see the big picture impact on your budget.

15. Part-Time Job Income Potential

Maximize your earning power:

- Research and list various part-time job options with average pay rates and typical hours.

- Include a “Skills Inventory” to match your abilities with potential jobs.

- Add a section on the pros and cons of on-campus vs. off-campus employment.

- Create a “Time Management Grid” to visualize how work hours fit with your class schedule.

- Include tips on turning hobbies into money-making opportunities, like selling crafts or offering music lessons.

16. Financial Literacy Tips

Become a money master:

- Include a “Term of the Week” section to build your financial vocabulary.

- Add “Did You Know?” boxes with interesting financial facts or historical tidbits.

- Create mini-challenges, like tracking every penny spent for a week or finding five ways to save $5.

- Include a section on understanding and building credit, with tips on using student credit cards responsibly.

- Add resources for further learning, like recommended books, podcasts, or free online courses on personal finance.

17. Seasonal Expense Planner

Be prepared year-round:

- Break down typical expenses for each season: fall textbooks, winter holidays, spring break, summer storage.

- Include a “Seasonal Job Opportunities” section for things like snow shoveling in winter or camp counseling in summer.

- Add a “Seasonal Savings Tips” box for each season, like buying winter coats in spring or swimwear in fall.

- Create a “Weather Preparedness” budget for items like rain gear or warm clothing if you’re in a new climate.

- Include a “Seasonal Transition Checklist” to prepare for upcoming expenses as seasons change.

18. Roommate Expense Splitter

Keep the peace with easy expense sharing:

- Create a shared expenses tracker, listing all common costs (rent, utilities, groceries).

- Include formulas for splitting costs fairly, especially if room sizes or amenities differ.

- Add a section on setting financial ground rules with roommates, like how to handle late payments.

- Include a “Communal Items Inventory” to track shared purchases and their costs.

- Create a digital payment tracker for easy settling up, using apps like Venmo or Splitwise.

19. Campus Resource Maximizer

Squeeze every drop of value from your tuition:

- Create a comprehensive list of free campus services: tutoring, software access, legal aid, etc.

- Include a “Savings Calculator” to show how much these free services would cost off-campus.

- Add a “Campus Job Board” section, highlighting work-study and on-campus employment opportunities.

- Create a “Freebie Calendar” marking events offering free food, t-shirts, or other goodies.

- Include tips on maximizing office hours, both for academic help and professional networking.

20. Future Planning Section

Set yourself up for post-graduation success:

- Create a “Five-Year Financial Forecast” to visualize long-term goals.

- Include a “Career Preparation Checklist” with costs for grad school exams, application fees, or certification courses.

- Add a “Relocation Budget” section for estimating costs of moving for jobs or further education.

- Create a “Student Loan Repayment Simulator” to understand future monthly payments.

- Include a “Life Milestones” section to start planning for big post-grad expenses like buying a car or renting an apartment.

Conclusion

Whew! That was quite the deep dive into college budgeting, wasn’t it? Remember, your budget planner is a living document – it should grow and change with you throughout your college journey. The key is to make it detailed enough to be useful, but flexible enough to adapt to your changing needs and goals.

By incorporating these in-depth ideas into your budget planner, you’re not just creating a financial tool; you’re crafting a roadmap for success in college and beyond. You’re learning invaluable skills in financial management, planning, and self-discipline that will serve you well long after you’ve tossed your graduation cap.

So go ahead, take these ideas and run with them. Customize your planner to fit your unique situation and personality. Make it colorful, make it fun, and most importantly, make it work for you. Your future self (and your wallet) will thank you for the effort you put in today.

Happy budgeting, and here’s to your financial success in college and beyond!